Company Overview

- Industry: Financial Services

- Company Size: 51-200 employees

- What They Do: Capital provider for private lenders and commercial mortgage brokers

Our Approach

We designed a straightforward A/B test to evaluate the impact of strategic ad scheduling on LinkedIn performance:

Test Structure:

- One single image ad campaign targeting top-of-funnel prospects

- Maximum delivery bidding strategy to optimize for reach

- Split testing: Version A with DemandSense scheduling vs. Version B with standard 24/7 delivery

Strategic Scheduling Approach:

- We scheduled ads to run from 5 AM to 6 PM on weekdays (Monday through Thursday)

- We avoided overnight and early morning hours when engagement is historically lowest

- We concentrated budget during peak hours (9 AM to 3 PM) when financial professionals are most active

The test ran for two weeks to gather sufficient data for a definitive comparison.

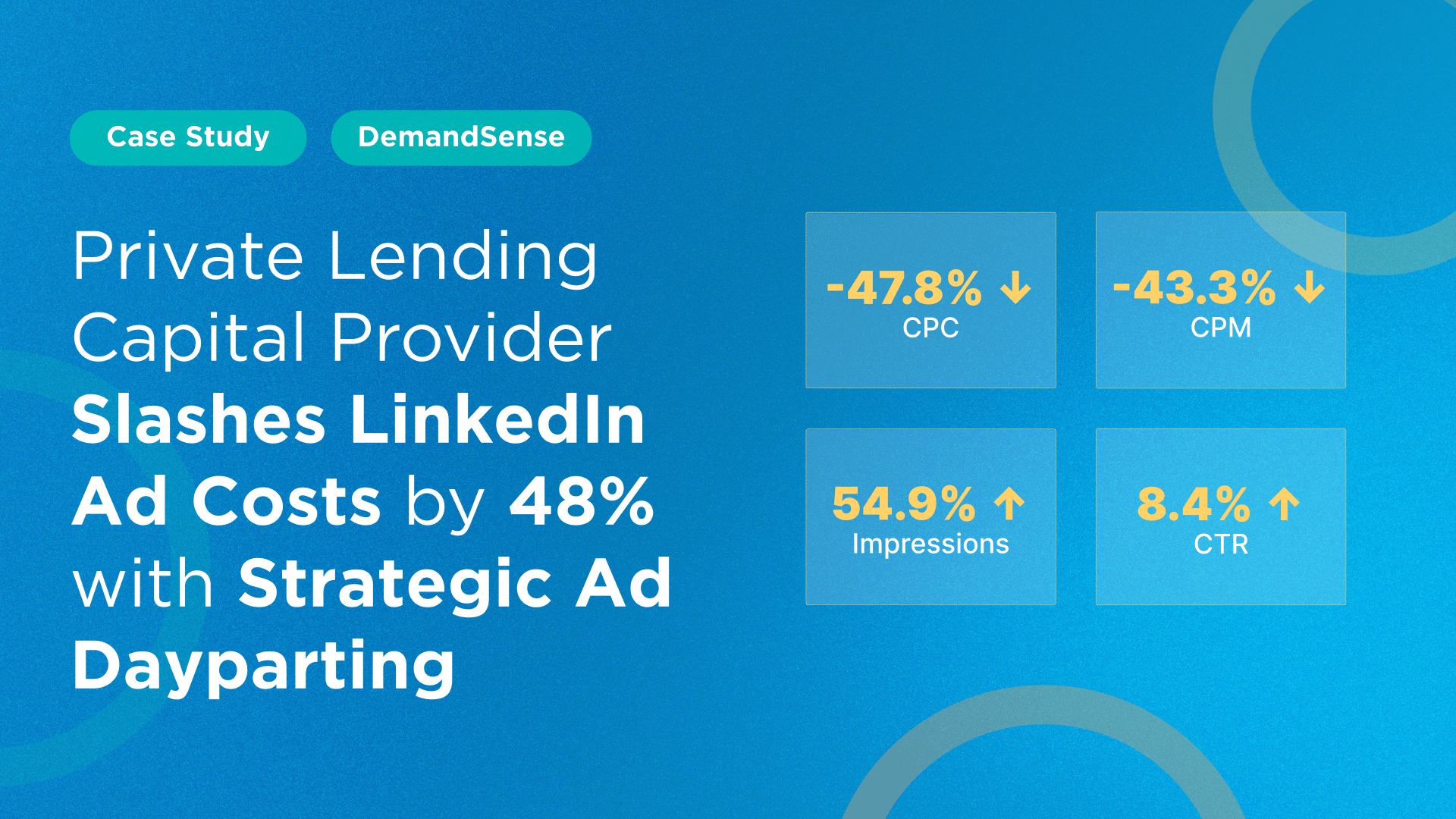

The Results

| Performance Metric | Improvement with Scheduling |

| Impressions | +54.9% |

| Click-Through Rate | +8.4% |

| Cost Per Thousand Impressions | -43.3% |

| Cost Per Click | -47.8% |

Key Findings Explained

1. Dramatically Increased Visibility

The scheduled campaign delivered nearly 55% more impressions, reaching substantially more potential clients without increasing the budget. This enhanced visibility came at exactly the right times—when real estate financing professionals were actively using LinkedIn.

2. Better Engagement Quality

The scheduled campaign achieved an 8.4% improvement in click-through rate. This indicates we were not just reaching more people, but connecting with them when they were most receptive to financial service messaging.

3. Exceptional Cost Efficiency

The most compelling results were in cost reduction:

- Cost per thousand impressions (CPM) decreased by 43.3%

- Cost per click (CPC) fell by an impressive 47.8%

These efficiency gains effectively doubled the power of the client’s LinkedIn advertising budget.

Why It Worked: Financial Services Industry Insights

The real estate financing sector has distinct professional rhythms that our scheduling approach perfectly aligned with:

- Business Hour Focus: Financial professionals conduct most of their research and decision-making during standard business hours

- Weekday Concentration: Lending decisions and financial research primarily happen Monday through Thursday, with Friday often reserved for closing deals and wrapping up weekly business

- Competitive Timing Advantage: By avoiding high-competition periods when major financial institutions dominate the ad space, we secured better rates and placement

Practical Takeaways for Financial Services Marketing

This case study reveals several key insights for financial services companies advertising on LinkedIn:

- Timing Precision Matters: Financial professionals have structured workdays that create optimal windows for ad engagement

- Cost-Efficient Competition: Strategic scheduling helps smaller financial firms compete with industry giants

- Quality Over Quantity: Targeting during business hours improves not just reach but also engagement quality

- Budget Optimization: Substantial cost reductions mean more opportunity to test new targeting segments

By implementing strategic ad scheduling through our DemandSense platform, this financial services provider was able to dramatically improve their LinkedIn advertising efficiency while connecting with more real estate professionals precisely when they were most receptive to lending solutions.